Sticking to a budgetĬhanging your money habits won’t happen overnight.

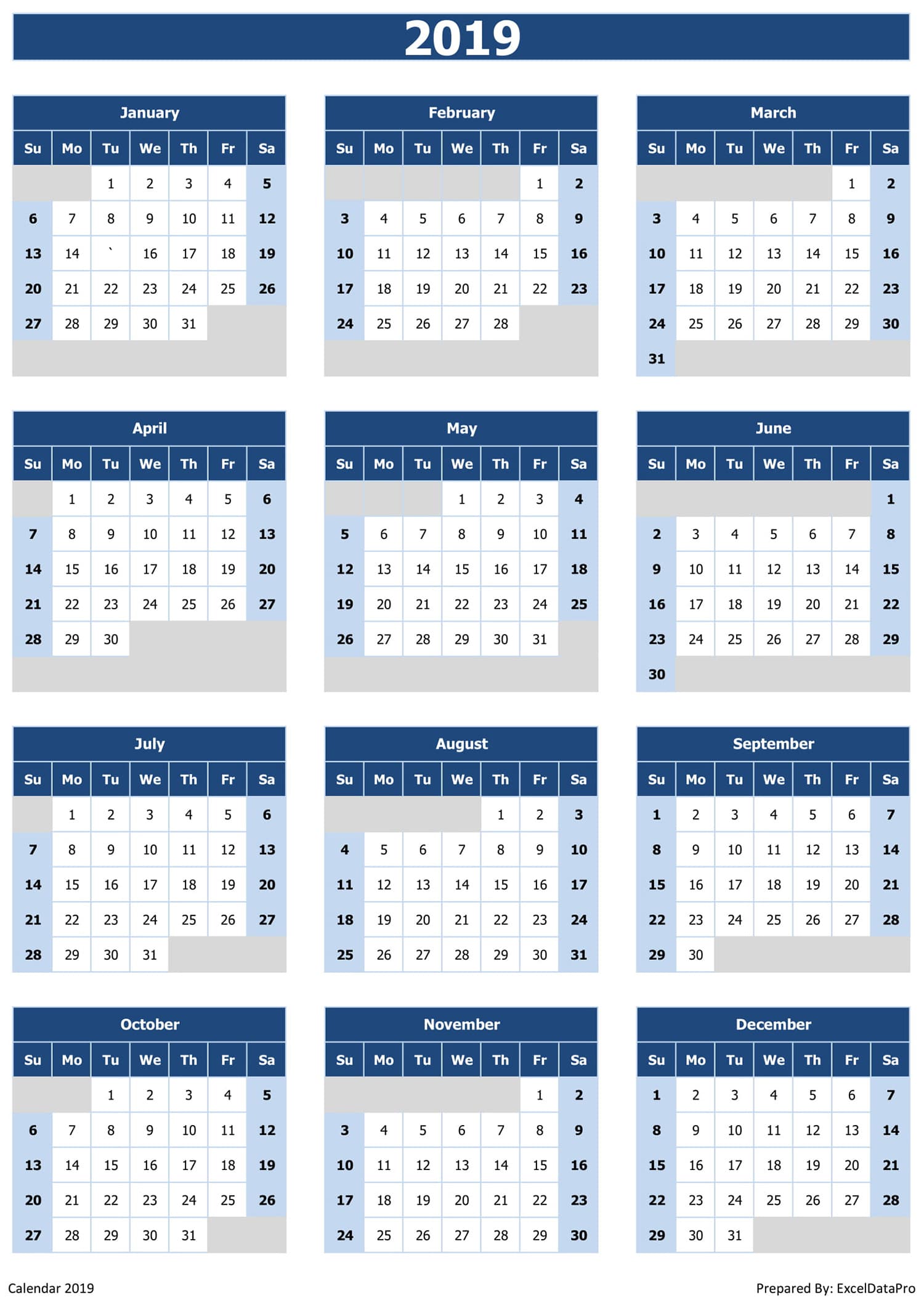

#BUDGET CALENDAR PRINTABLE 2019 UPDATE#

Be sure to update your budget if you experience a change in employment or your spending habits. Once you’ve identified all of your income sources and started tracking your spending and when your bills are due, our Budget Worksheet pulls everything together so you have a working and realistic budget.Ĭreating a budget will help you figure out if you have enough money to cover your expenses, while also having enough to save or spend on something extra you may want for yourself or your family. Missing payments or not paying on time can also have larger impacts on your credit scores and overall financial well-being. Our Bill Calendar is designed to help you remember when your bills are due but also keep in mind weeks when you need to be careful about your spending. Step 3: What are all my bills and when are they due? If you’re coming up short at the end of the month, it could be that the timing for your bills and income don’t match.You could also start a daily log of your expenses so you’re making sure to capture those small expenses - like buying breakfast or lunch instead of bringing it with you - that add up over time. If this feels overwhelming, start small and look at your expenses one week at a time by either reviewing your receipts or checking account. Our Spending Tracker helps you both log and sort your spending by categories like utilities and housing to eating out and entertainment. Step 2: Where does my money go? Equally important but the heaviest lift is logging your spending so you get a realistic picture of what your money, on an average month, is going to.Start by recording all of your income with our Income Tracker. You may be self-employed, have multiple jobs or receive child support or government benefits - all of these sources should factor into what you have available to make ends meet. Step 1: Where does my money come from? The first place to start is getting a complete picture of where your money comes from.Getting started can be the hardest part, especially if your finances feel out of control, but these easy-to-follow steps are designed to help you create a budget that really works for you. Until you get a realistic picture of how much money you’re bringing in and where it’s going, it’s difficult to know whether you’ll have enough left over to put away. Let’s say you want to set money aside for emergencies or you aspire to save up for a much larger goal like a car, down payment on a house, or retirement. Making and sticking to a budget is a key step towards getting a handle on your debt and working towards a savings goal, of any kind.

0 kommentar(er)

0 kommentar(er)